Carbon accounting is the process of measuring, quantifying, and tracking the greenhouse gas emissions generated by an organisation or entity. It involves collecting data on various activities and operations that contribute to emissions, such as energy consumption, transportation, waste management, and production processes. Essentially, carbon accounting involves mathematically translating your business activities into measurable carbon emissions.

There are various terms used interchangeably with carbon accounting, including, but not limited to:

- Carbon assessment

- Carbon auditing

- Carbon balance

- Carbon footprint

- Carbon inventory

- Carbon management

- Carbon monitoring

- Carbon reporting

- Carbon tracking

- Emissions accounting

- Emissions inventory

- Greenhouse gas (GHG) accounting

- Greenhouse gas (GHG) inventory

These terms all refer to the same concept: measuring your organisation’s CO2e (carbon dioxide equivalent). CO2e is a standardized unit that accounts for the warming effect of different greenhouse gases based on their global warming potential (GWP). For instance, one metric ton (MT) of methane has a warming effect 29.8 times greater than that of CO2 over the same period, making it equivalent to 29.8 metric tons of CO2e.

Why does carbon accounting matter?

Given the urgent need to address climate change, managing our carbon footprint is crucial. But did you know that carbon accounting also offers several benefits to organisations? Here are some reasons why carbon accounting is good for business:

- Compliance and regulatory requirements: Carbon accounting is set to become a mandatory practice for companies worldwide, driven by a range of global frameworks and government rulings, including the TCFD reporting framework, ISSB rulings, and upcoming SEC rulings in the United States. Overall, these frameworks and rulings will lead to more standardized and comprehensive carbon accounting practices. They will enhance transparency, comparability, and accountability in reporting carbon emissions, enabling better decision-making, risk assessment, and target-setting for businesses. These rulings will also create a greater sense of urgency and responsibility for companies to measure, manage, and reduce their carbon footprint in order to meet regulatory requirements and stakeholder expectations. By conducting carbon accounting, businesses can ensure compliance with these regulations, avoiding penalties and legal risks. Proactively addressing emissions and having accurate data also positions businesses well in the face of future regulatory developments.

- Cost savings: By measuring and understanding their carbon emissions, businesses can identify inefficiencies and areas for improvement in their operations. This can lead to cost-saving opportunities through energy efficiency measures, waste reduction, and resource optimisation. Implementing sustainable practices and reducing emissions can result in long-term cost savings for businesses.

- Enhanced reputation and branding: Consumers increasingly prioritise environmentally responsible and sustainable companies. By actively engaging in carbon accounting and reducing their carbon footprint, businesses can improve their reputation and differentiate themselves in the market. Demonstrating a commitment to sustainability can attract environmentally conscious consumers and enhance brand loyalty.

- Investor confidence: Investors are increasingly incorporating environmental, social, and governance (ESG) factors into their investment decisions. Carbon accounting allows businesses to provide transparent and credible information about their environmental performance, aligning with the expectations of socially responsible investors. Strong ESG performance, including robust carbon accounting practices, can attract investment and enhance investor confidence.

- Risk management: Climate change and its impacts present significant risks to businesses, including physical risks, regulatory risks, and reputational risks. Carbon accounting helps businesses identify and assess these risks, enabling them to develop appropriate strategies for mitigation and adaptation. By proactively managing carbon emissions, businesses can reduce their exposure to climate-related risks.

- Competitive advantage: Companies that prioritise sustainability and actively manage their carbon footprint gain a competitive edge in the marketplace. Consumers, clients, and partners are increasingly seeking environmentally responsible business partners. Carbon accounting demonstrates a commitment to sustainability and can differentiate businesses, providing a competitive advantage.

Overall, carbon accounting aligns business operations with environmental goals, drives cost savings, enhances reputation, and ensures compliance. It positions businesses strategically in a changing business landscape, enabling them to thrive in a low-carbon and sustainable future.

What does carbon accounting involve?

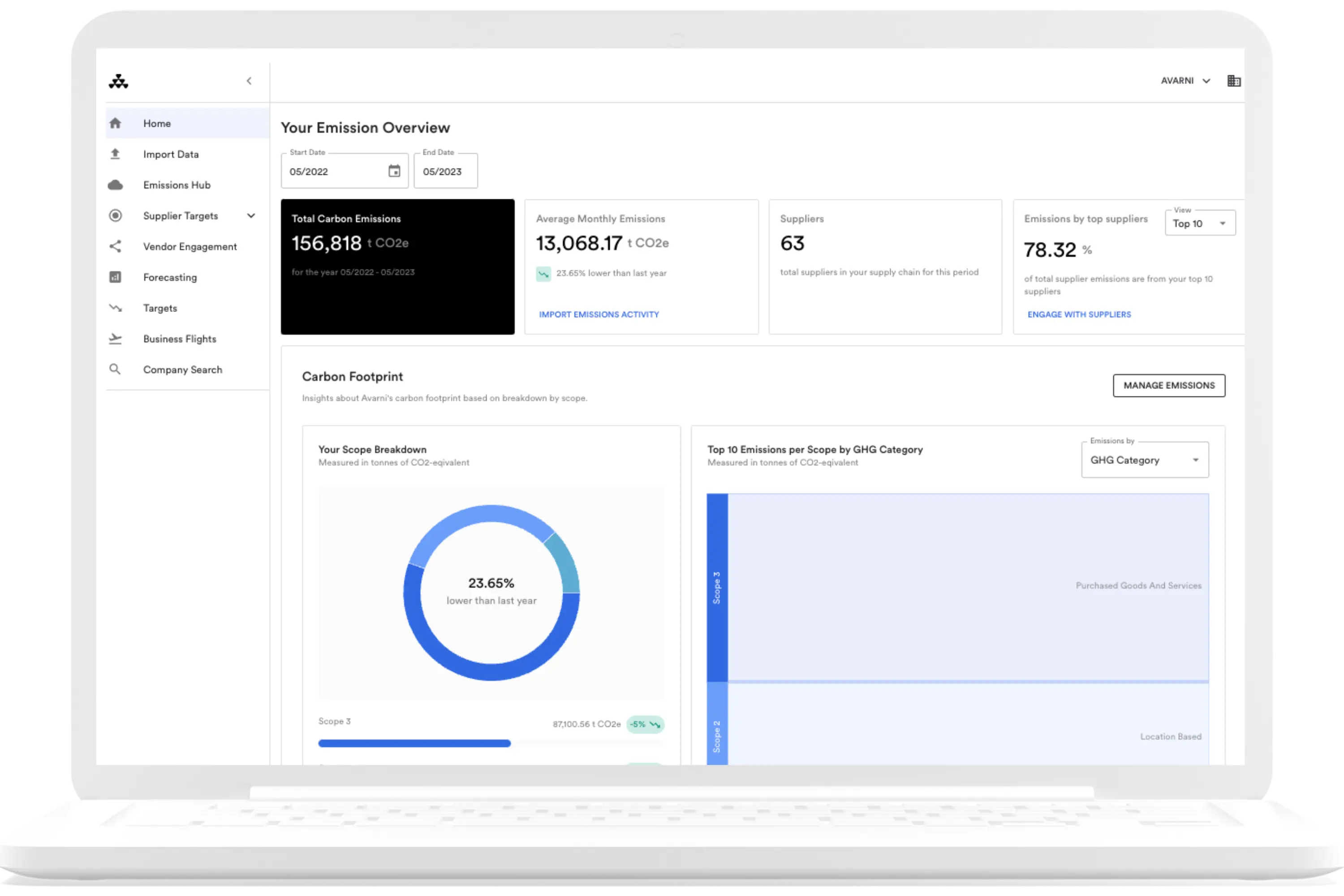

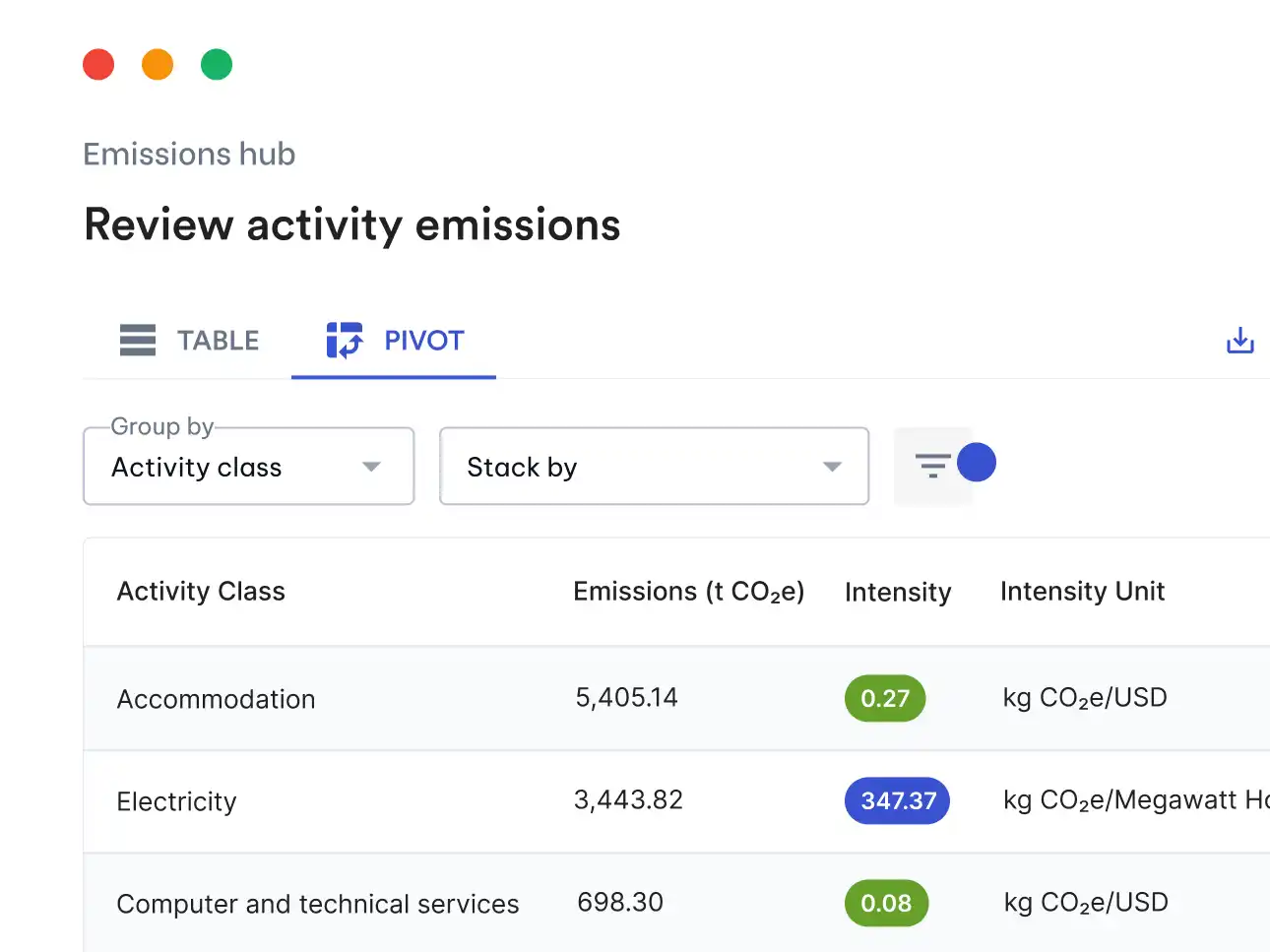

In simple terms, carbon accounting involves assessing your business's carbon footprint and converting the results into CO2 equivalent (MT CO2e). These mathematical calculations are complex and have traditionally required expert guidance. However, carbon accounting platforms like Avarni simplify the process by translating business activities (spend and activity data) into emissions outputs.

Here’s how to get started with carbon accounting:

1) Identify the sources of your company’s carbon emissions

These are broken-up into three types of emissions, or Scope 1-3 emissions:

- Scope 1 emissions — the direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by your company (for example, emissions associated with fuel combustion in boilers, furnaces, and vehicles).

- Scope 2 emissions — the indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.

- Scope 3 emissions — all indirect emissions that come from activities that occur in your company’s supply chain, but are not directly controlled by your company. These sources include the use of purchased goods and services, fuel- and energy-related activities, employee business travel, waste generated from operations, transport-related activities, and the use of leased assets. On average, Scope 3 emissions account for over 80% of an organisation's emissions so this will be the biggest source of emissions and will require the most time to identify.

2) Measure your company’s carbon emissions

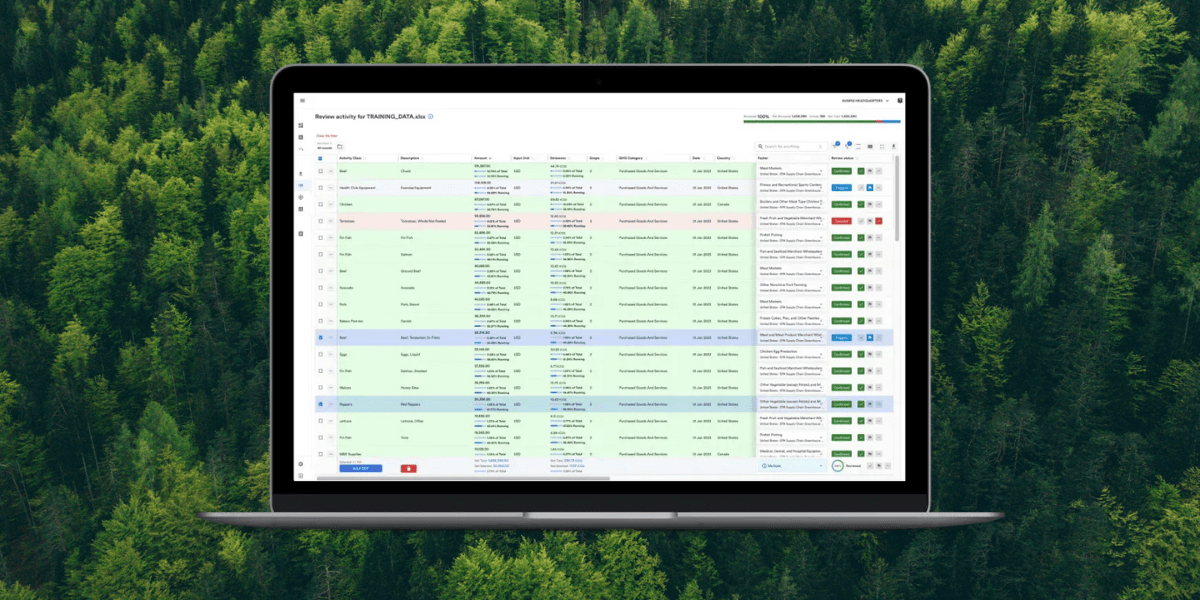

Once you have identified the sources of your organisation’s emissions, you can begin calculating your carbon footprint. While organisations traditionally performed manual emissions calculations using a carbon accounting spreadsheet, they can now leverage purpose-built carbon management software such as Avarni to greatly automate this process. A robust solution will allow you to simply upload your spend data (procurement spend, utility bills, fuel receipts), or connect to your existing finance applications. It will then take the financial value of your purchased good or service and multiply it by an emission factor – the amount of emissions produced per financial unit – resulting in an estimate of the emissions produced. This will automatically calculate your company’s total emissions, and allow you to visualise its carbon footprint.

Because the vast majority of your company’s emissions likely come from its value chain, you should seek out a solution like Avarni that allows your suppliers to upload their own Scope 1-3 emissions into the platform. This will save time and effort on your part, while providing a comprehensive view of your value chain emissions and ensuring that all emissions associated with your organisation are accounted for. From there, you’ll be able to identify hotspots in your supply chain and start working on emissions reduction strategies.

How can carbon accounting help reduce carbon emissions?

Once you have measured your company's carbon emissions, you can begin to develop strategies for reducing them. Using a tool like Avarni allows you to forecast what your future emissions will look like under a number of different scenarios, such as switching to renewable energy sources, or working more closely with suppliers that have committed to net zero targets. These data-driven insights allow your procurement team to make more sustainable decisions and work collaboratively with suppliers to reduce shared emissions over time.

Finally, once you have a carbon accounting system in place, you can consider implementing a carbon offset program. This involves investing in projects that reduce emissions elsewhere, such as planting trees that absorb carbon dioxide or investing in renewable energy projects. Offsetting your company's carbon emissions can help make up for any emissions that your company is unable to reduce currently.

Automate your carbon accounting

Carbon accounting can be perceived as a complex and daunting task, but with the right carbon management platform, like Avarni, it becomes significantly easier and more accessible.

Avarni simplifies the carbon accounting process by streamlining data collection, calculations, and reporting, eliminating the need for manual and time-consuming calculations. We automate the complex mathematical calculations involved in converting business activities into emissions outputs, ensuring accuracy and efficiency. This empowers you to streamline your carbon accounting processes, enabling you to focus on implementing effective emission reduction strategies and driving sustainability initiatives within your organisation.

Avarni makes carbon accounting a more accessible and manageable task for your organisations, supporting you in your journey towards a low-carbon future. Get in touch to get started today.