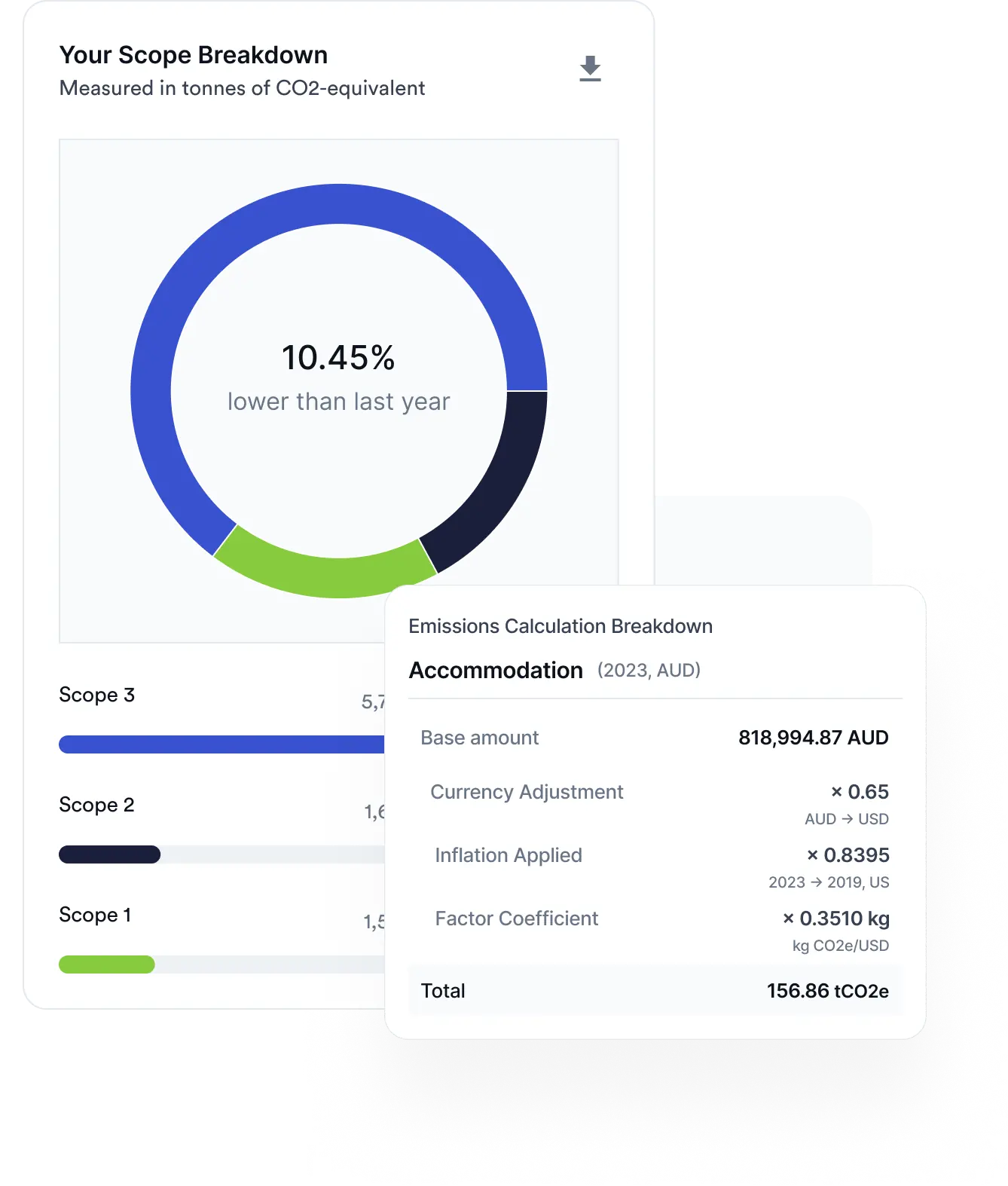

Deliver audit-ready sustainability reporting for your financial or insurance organisation

Avarni helps financial and insurance entities meet ASRS climate disclosure requirements cost-effectively by replacing manual spreadsheets with a fast, accurate, and audit-ready platform.

Trusted by leading organisations

Overcome sustainability reporting challenges with Avarni

Financed and insured emissions

CHALLENGE

Complex scope 3 data from loans, underwriting, and investments.

SOLUTION

AI-powered calculations to capture and report financed and insured emissions with precision and speed.

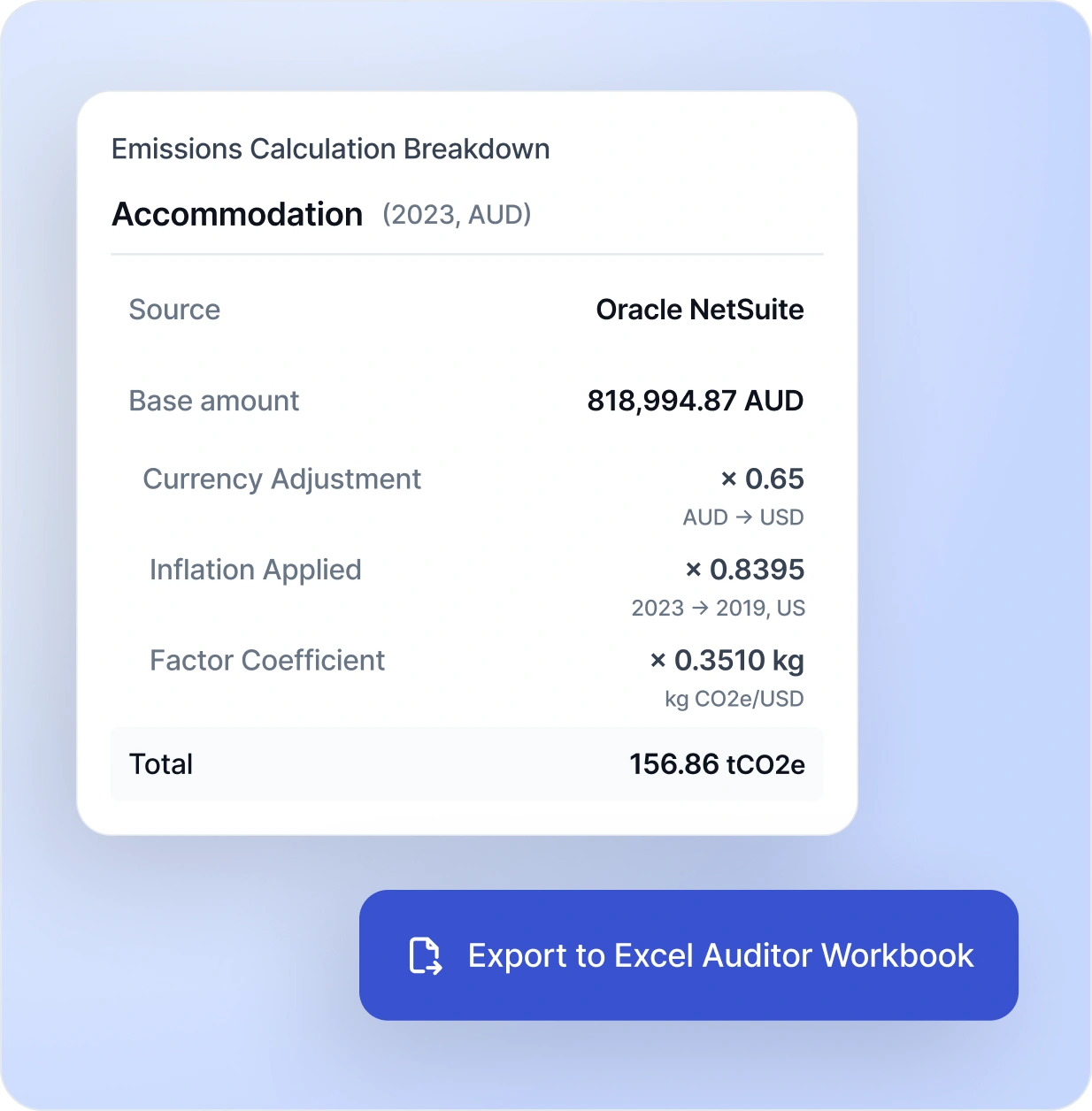

Auditability and assurance

CHALLENGE

Regulators demand full transparency and audit-ready disclosures.

SOLUTION

Every input and assumption is logged, ensuring ASRS-compliant, auditable reports.

Data fragmentation

CHALLENGE

Emissions data scattered across systems, regions, and formats.

SOLUTION

Integrates and consolidates data into one source of truth, filling gaps through counterparty engagement.

Risk and scenario analysis

CHALLENGE

Transition and physical climate risks are complex to model.

SOLUTION

Stress-test portfolios with scenario modelling to inform strategy and capital adequacy.

Enterprise complexity

CHALLENGE

Multiple business lines, asset classes, and geographies make compliance difficult.

SOLUTION

Avarni adapts to your structure with custom mapping and emission factors, delivering ASRS-aligned disclosures across governance, metrics, risk, and strategy.

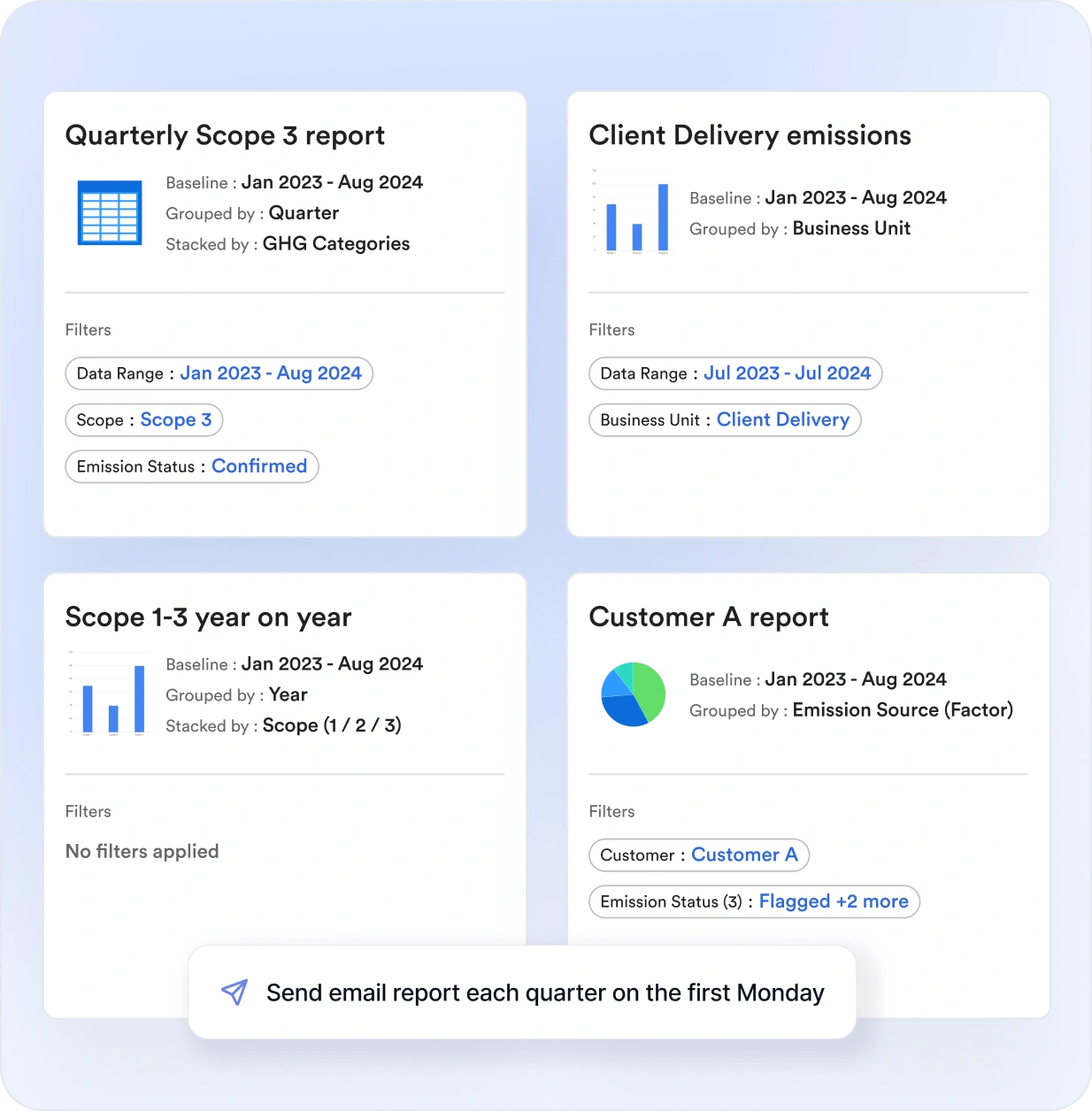

See how Avarni automates your mandatory climate disclosures

Watch our 10-minute demo for an end-to-end walkthrough of how Avarni’s sustainability software helps you cost-effectively achieve your sustainability reporting compliance goals.

Strengthen outcomes for your financial and insurance services organisation

Researching ASRS? Get your free compliance starter kit.

Get the ASRS Compliance Starter Kit (20+ guides, templates & checklists) delivered to your inbox for free.

20+ guides, templates & checklists sent to your inbox instantly.

About Avarni

Real cost of climate compliance delays

Don't let inadequate carbon accounting put your business at financial risk.

ASIC has issued tens of millions in fines for greenwashing violations. Net zero statements without proper data backing are explicitly next on their target list.

Superannuation funds and institutional investors are actively divesting from companies with climate risk. Poor compliance = loss of major investment partners.

Rushing compliance at deadline creates exponentially higher costs, poor data quality, and increased regulatory scrutiny. Early action saves significantly.

Underinvesting in carbon accounting creates substandard reports that won't satisfy investors and increase regulatory risk.