In the race to net zero, there is a reality that needs to be faced – most emissions reductions around the world will be driven by regulation. Much of this regulation will come in the form of carbon pricing – essentially, putting a monetary liability on each tonne of carbon that an organisation emits.

In the voluntary market, if an organisation wants to become carbon neutral, carbon credits can be thought of as a form of pricing, where the price of each credit (equivalent to one tonne of carbon offset) is the carbon price. For example, if the price of a credit is $50, and an organisation has emissions of 100,000 tonnes of CO2e, then it will have to pay $5,000,000 in order to become carbon neutral.

Regulation, however, is likely to come in the form of a carbon price for emissions above a certain limit. An enterprise will be assigned a limit for how much it can emit in a given year, and if it exceeds that limit, it will have to pay the carbon price on each tonne it emits over its limit.

Carbon prices will increasingly be applicable to smaller companies as well as large enterprises. If an enterprise is managing their own emissions effectively and staying below their carbon limit, but their supply chain is not, the extra cost incurred by supply chain partners will inevitably be passed down to the enterprise, as an increase in the cost of goods & services they purchase. This means that it is essential to manage not just the emissions of your own operations, but also the emissions of your value chain.

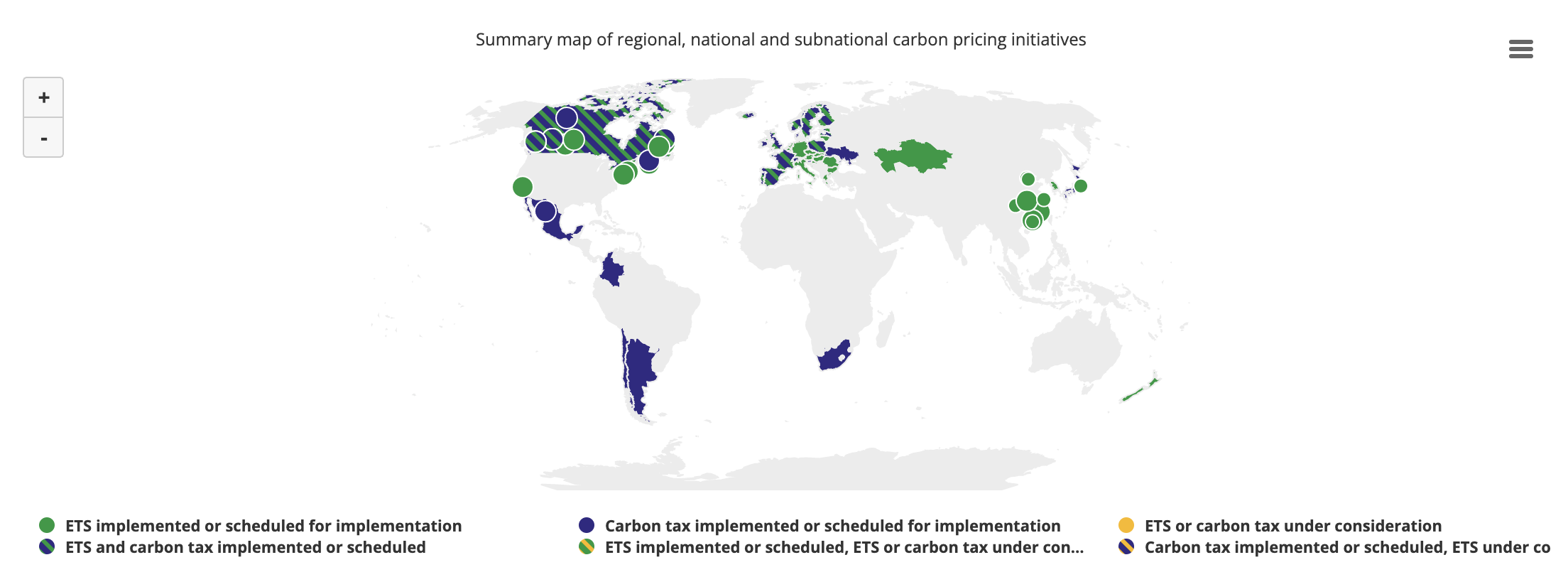

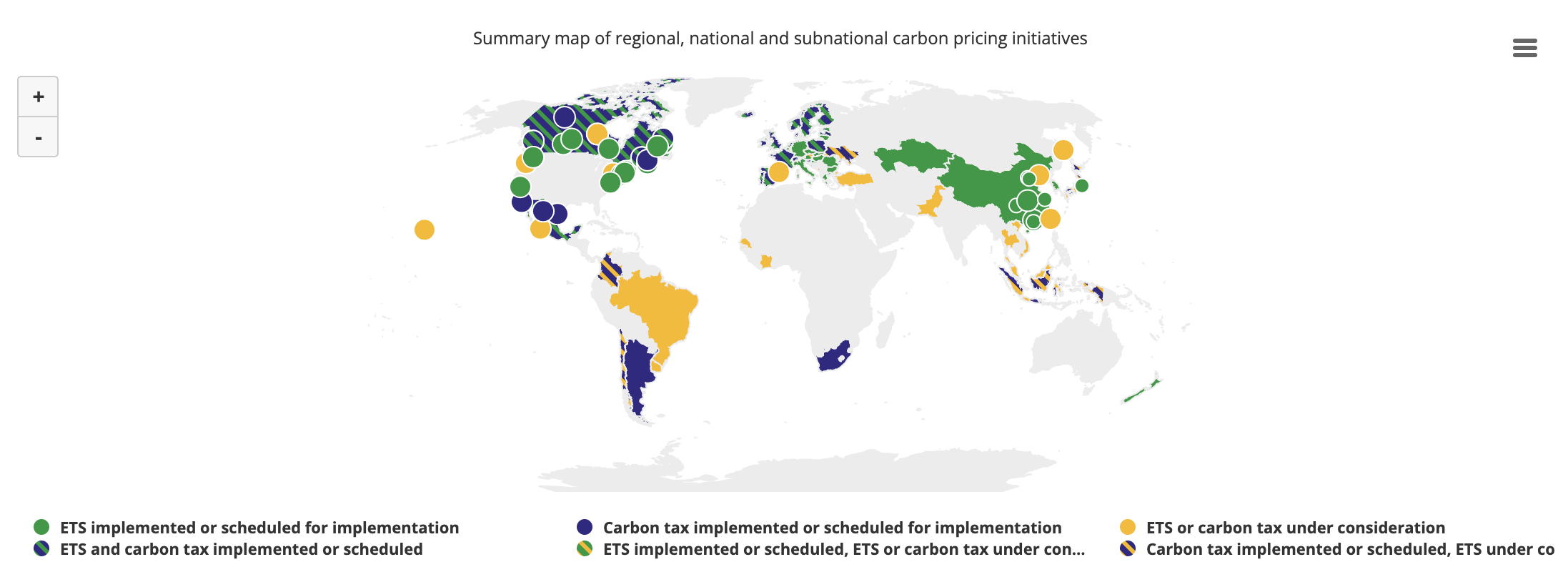

Current carbon pricing schemes around the world

According to the World Bank, there are a total of 65 carbon pricing schemes currently implemented around the world, as well as many more planned. You can see the increase in coverage in the maps below from 2019 to 2021.

An important point to note is that even if an organisation is in a jurisdiction that is not covered by a carbon price, it could still be affected by international prices – if the organisation is in an export business and it exports carbon intensive products to a country with a price, there could be a tariff imposed on the organisation’s products by that country.

As global coverage of carbon prices increases, the cost of credits is set to skyrocket, since purchasing demand will be high from organisations subject to emissions limits. All these factors mean that there is significant financial risk to any organisation that does not prepare for carbon pricing by actively keeping track of how much carbon they emit, and beginning to implement reduction strategies that will ensure they fall below their emission limits once they are imposed.

How can organisations prepare for carbon pricing?

The most effective way to prepare for regulatory carbon pricing as an organisation is by proactively imposing an internal carbon price from today. This can be used to place a monetary value on the carbon risk across the organisation, and begin mitigating that risk before regulation comes in.

Internal carbon pricing is not an untrodden path. According to a report by the CDP, over 2000 of the world’s largest companies are already using an internal carbon price as a risk management tool.

However, in order for an internal carbon price to be effective, there needs to be buy in not just from key stakeholders across the organisation, but all employees. Some ways this could be done for different business divisions includes:

- For procurement, tying budget to the internal carbon price. If a supplier’s measured emissions exceed a certain carbon limit, the price is imposed on every tonne emitted above that limit by the supplier, increasing the cost of procuring from them. This makes procuring from lower carbon emitting suppliers the right financial decision.

- For managers of business units, bonuses could be linked to whether their business unit stays below their carbon limit. By setting emissions performance as a key metric for whether a bonus is awarded or not, business unit managers have a direct incentive for making sure emissions are kept below their limits.

- Business flights are often a large portion of the footprint of an organisation that provides mainly services, rather than physical goods. Organisations can set a carbon limit for business flights for each division, and if that division exceeds their limit, the excess emissions get priced based on the carbon price, and then that monetary amount gets taken out of the division’s spending budget. This is a very effective way to incentivise reduced business travel, which not only reduces emissions, but also reduces cost for the organisation.

How Avarni can help your organisation set an internal carbon price

There are many ways an organisation can decide what its internal carbon price should be. It could use pricing that is proposed for the legislated carbon price, if they are in a country where one is planned. Or, they could use recommendations from reputable authorities – the United Nations Global Compact recommended that businesses adopt an internal carbon price of 100 USD per tonne by 2020.

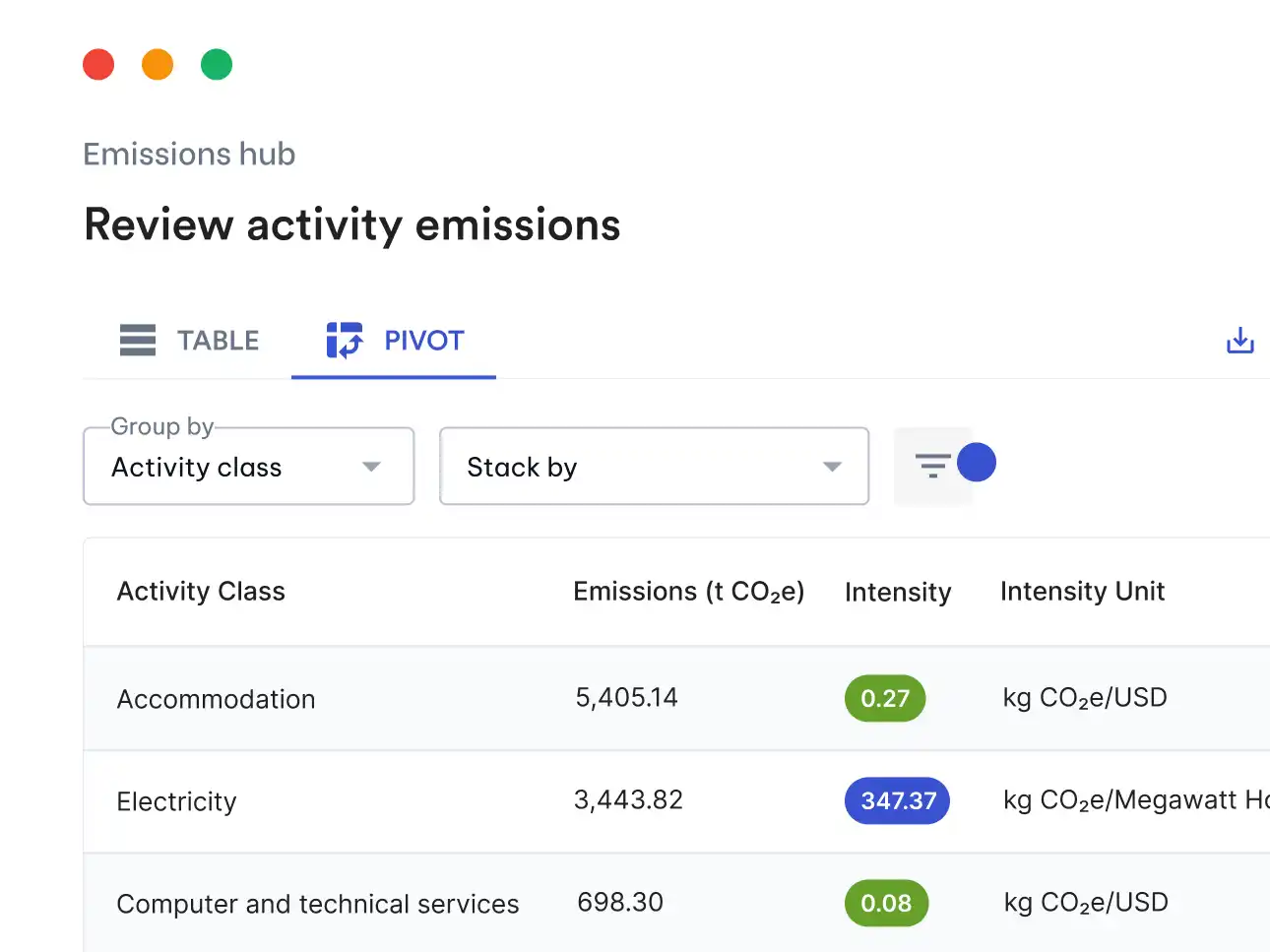

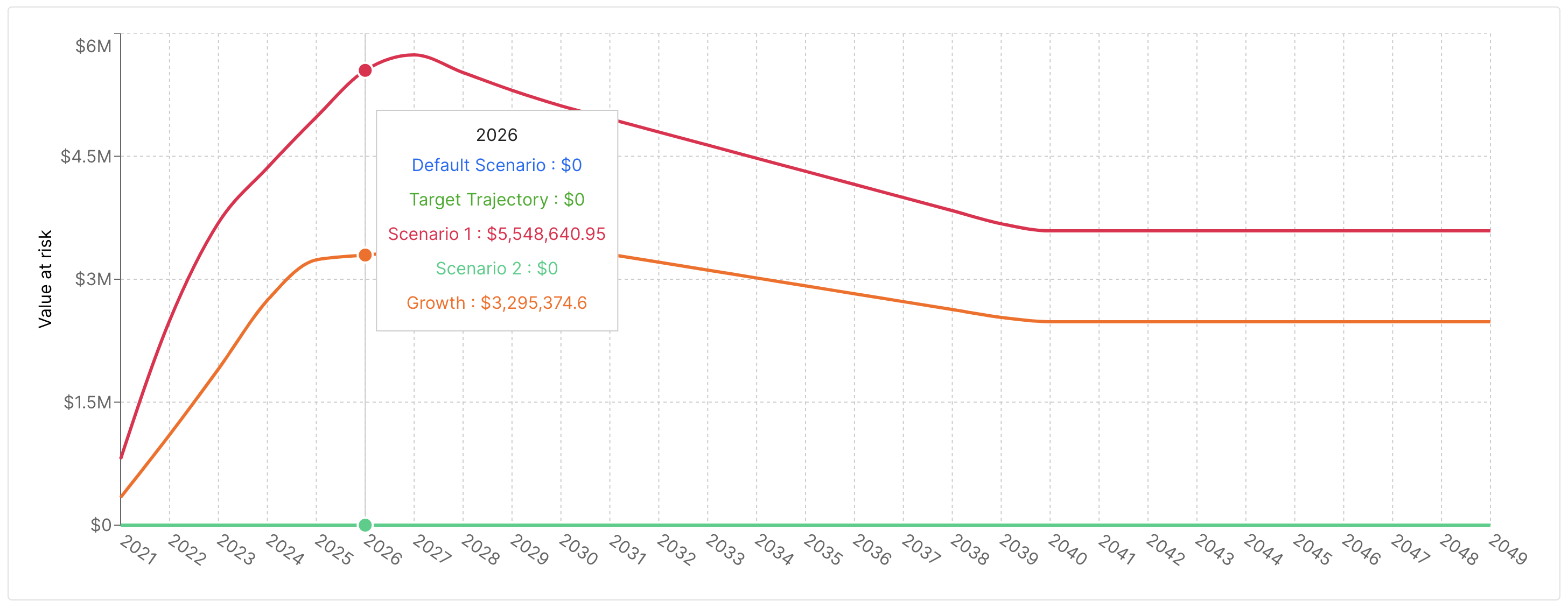

However, once an internal carbon price is set, it must be managed and shared with all internal stakeholders, and the value at risk (carbon price multiplied by total emissions) within the company and its supply chain needs to be monitored continuously. If you are over your carbon limit at any given time, how do you know what your liability is?

Avarni allows you to set up carbon prices alongside your real-time emissions tracking, allowing your finance team to see exactly how close the organisation is to its carbon limit – and if it has exceeded it, what its monetary liability is.

This makes it easy for all relevant stakeholders across the organisation to keep track of how they are tracking towards their carbon limits month on month, per quarter, and for the overall reporting year – which is exactly what will be required of them once regulation comes in that mandates limits on their emissions.

Want to make sure you are prepared for mandatory carbon pricing, and join the thousands of companies already proactively pricing their emissions internally? Book a call with Avarni to find out how we can help your organisation today.